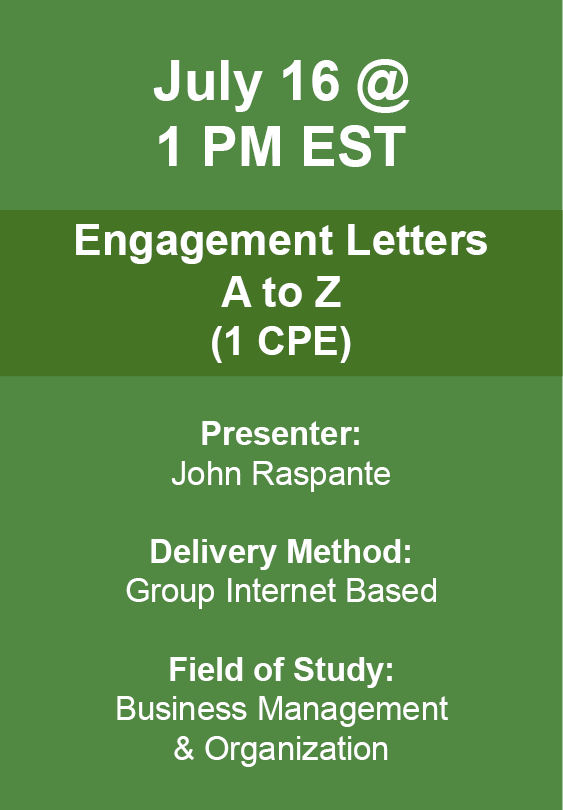

Course Description:

Engagement Letters are a very important tool in any CPA’s risk management toolbox! Many times, well-written engagement letters have stopped a claim from happening. In this updated 50-minute presentation, presenter John Raspante will discuss the engagement letter in response to the changes in tax law and the challenges in the accounting profession. John will point out the different caveats and clauses that all CPA firms should consider in their engagement letter language. Caveats will be discussed to address the rapid changes in both tax and A&A. Included will be clauses to manage the impact of the Way Fair decision, Pass-through entity taxes, and Cannabis.