Attorneys dread doing their annual Law Firm Attorney Malpractice Applications. It is non billable administrative time that takes away from the practice of law. Depending on the firm this task may be handled by the Managing Partner; the beginning associate; or newest clerk in the office. While expedient having the newest staff member complete the application it potentially opens the firm to denied claims and at worst or coverage rescission. The finger pointing for a poorly completed application many times begins with a denied claim.

Attorneys dread doing their annual Law Firm Attorney Malpractice Applications. It is non billable administrative time that takes away from the practice of law. Depending on the firm this task may be handled by the Managing Partner; the beginning associate; or newest clerk in the office. While expedient having the newest staff member complete the application it potentially opens the firm to denied claims and at worst or coverage rescission. The finger pointing for a poorly completed application many times begins with a denied claim.

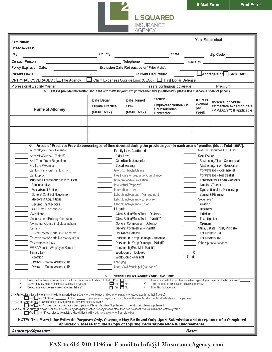

Either above or below the signature line of most applications have a phrase like the following:

“I hereby acknowledge that the aforementioned statements and answers are correct and complete to the best of my knowledge and belief and that all information provided including this application, its supplements, attachments and answers to any questions asked by our underwriter will be relied upon by the Company in determining whether to insure and at what rate to insure.”

Insurers rely on the new business attorney malpractice application to determine if your firm is acceptable. The application and subsequent information may cause exclusions added to the policy, or may trigger policy exclusions. Beyond this the application also determines what rate to charge. Underwriters review available information on the internet to cross check the application. In addition, if the firm has previously submitted an application to an insurer, it is likely that the underwriter will have access and cross check. Sometimes even innocent errors in completing the application may get the firm rejected if the story told by the application and other information are not the same. Underwriters hate surprises. Surprises can increase rates and/or get coverage declined even if corrected later.

A firm can also be tripped up on a renewal application, particularly with failure to disclose potential or actual claim activity or material changes in the firm’s practice or procedures.

Minimum steps that need to be taken while filling out the application:

1. Have a staff member complete the application that is familiar with the firm’s controls and past insurance and claims history.

2. Make sure the roster of attorneys is correct and complete. Many applications ask for all ‘lawyers’ with the firm. Even if the firm considers, an attorney a ‘paralegal’, if licensed include the attorney on the attorney roster. You can explain the ‘paralegal’s’ duties.

3. For any questions about potential claims, disciplinary matters, outside interests such as a directorship or a geographic area for a client outside of the firm’s normal pattern of clients; the firm should poll the entire staff about these matters. Explain any claims or disciplinary matters concisely. Don’t just attach the initial complaint to explain the claim and save time unless you really do not want coverage from this insurer. Initial complaints can contain ‘alternative facts’ and will not put your firm in the best of light. By all means explain how these types of issues can be avoided in the future.

4. With a multi-member firm, a second member of the firm should review the completed application once completed to determine its accuracy.

5. A timely application will save the firm time and money in the long run. 5 to 10 working days should be considered a minimum for getting the application to the agent. If the application shows up the day of expiration in the agent/insurers office ‘surprise’ declinations by the insurer can not only be a cover problem, but will increase overall insurance costs.

An application with supplements can be normally completed within an hour or two. Gathering the information needed, such as polling the staff, can take a number of days. It is best to start this process long before the expiration date. Remember the whole application needs to be complete prior to submission.

Remedies for insurers for incomplete and/or misleading applications can result in a change in premium, coverage withdrawn or being non-renewed. A material error in fact on the application can cause a claim to be denied. At the most extreme, it could result in rescission of coverage.